Partial eMMC prices spark now? Storage spot prices continue to consolidation this week, waiting for return requirements

2023-06-05 分类:行业动态

With the stable release since may customers original price signal, the upstream NAND Flash and DRAM resource prices adjust the amplitude and frequency is reduced, also significantly weakened the SSD memory storage products such as a drop in prices of kinetic energy, and a simmering embedded storage, storage spot market together in the bottom of the consolidation, closely observed in the first half of the year ending in June, whether storage market will be more change.

DRAM market more stable than NAND, channel upside down level improved, some eMMC up slightly

Combination of upstream memory chip prices and spot prices of downstream store products, spot DRAM market than the NAND market more stable, namely memory DDR particles as well as product prices generally will remain unchanged. At the same time, local media reported recently, Q2 samsung DRAM chip shipments to rose 15% to 20%, reversing a Q1 - fell 10%, while SK hynix Q2 shipments are expected to rose 30% to 50%, far higher than 20% of the market consensus, market expectations of DRAM improvement of supply and demand is more optimistic.

Recently, on the other hand, embedded storage after stability sideways, spot market appears poised state, storage vendor actively seeking opportunities and gains rise in price. This week 32 gb and 64 gb eMMC edged up, market stranger to have positive signal, but still need to raise after the continuous observation, and whether it can effectively cover a larger scope. According to CFM the flash memory market understands, embedded LPDDR4 plentiful supply price is not easy to rebound, the spot market mainly for embedded flash memory products for positive attempt.

Due to adjustment of the original price strategy of upstream, nearly a month memory chip prices remain relatively stable, also reduced the stored kinetic energy of the finished product prices fell. Downstream through the cost of inventory to cover smooth, and generally the market price of the sideways, channel hangs levels to change. Can be expected as the bottom price, even if short-term market is difficult to rise, the downstream manufacturers operating level will be improved. Only the current terminal represented by the demand side did not see clear warming signals, in the storage market consolidation for demand in return.

This week in the upstream resources, DRAM resource prices remain unchanged, some Flash Wafer slightly adjusted, 1 TB / 512 gb Flash Wafer cut $0.01 to $2.95 and 1.42, respectively.

Flash Wafer最新报价

DDR最新报价

渠道市场方面,整体流通状态一般,本周渠道SSD和内存条价格维持稳定不变。

渠道市场SSD最新报价

渠道市场内存条最新报价

行业市场方面,本周行业256GB/512GB/1TB PCIe SSD价格分别下调0.3/0.5/0.5美元至13.50/21.50/38.0美元,1TB SATA SSD下调至36美元,行业内存条价格维持不变。由于美光事件后续影响扩散,部分细分行业市场有望加速国产SSD和内存产品的应用。

行业市场SSD最新报价

行业市场内存条最新报价

卡和U盘方面,本周价格整体维持不变,中低端市场涨价后需求有所回落,中低端价格出现松动的迹象。

嵌入式行情方面,本周32GB/64GB eMMC涨价成功,均上调0.05美元至1.75/2.65美元,部分嵌入式存储行情在持续酝酿价格调涨,需要观察价格能否有持续性,以及涨价火花能否蔓延至更多的嵌入式存储产品。

eMMC最新报价

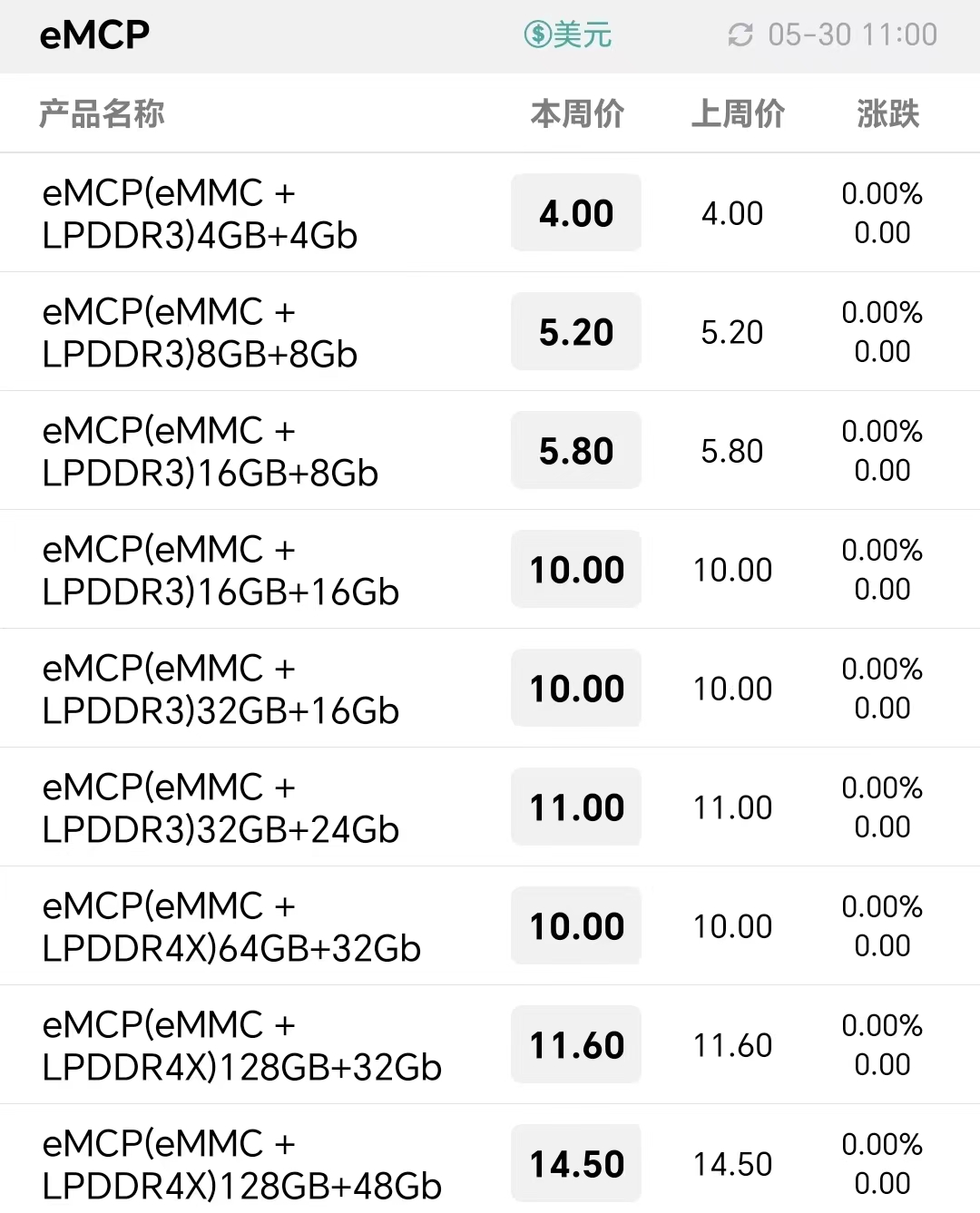

eMCP最新报价

LPDDR最新报价

UFS最新报价

uMCP最新报价

Scan QR code and add customer

MTA32ATF4G64HZ-2G6B2 SODIMM DDR4 MICROM

MTA32ATF4G64HZ-2G6B2 SODIMM DDR4 MICROM